Our strategy

A global multi-thematic approach to impact investing.

A global multi-thematic approach to impact investing.

Our research focuses on identifying innovative businesses positioned to benefit from the powerful combination of shifting regulation, disruptive technologies, evolving consumer demand, smart cities, and human dignity.

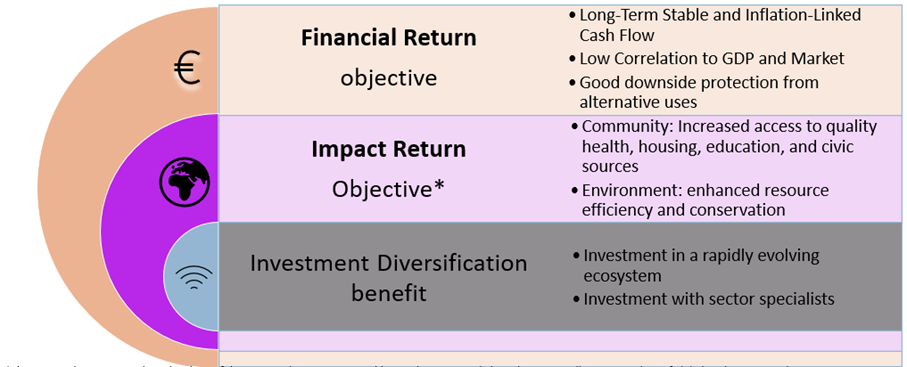

We have a structure that seeks to identify “win-win” investment opportunities where an “Impact Return’’ is achieved together with a “Financial Return’’ at market level, and offers a diversified portfolio of attractive investments accessible to qualified investors.

- Making money work for positive change in society

We perceive impact investing as a driving force in the transition towards a more inclusive and sustainable world. Investors should come in business to help create a society that supports communities, protects, and promotes the quality of life of all humans on a thriving planet with human dignity at its core.

- All money has impact!

We help people who would like to shift the purpose of their investment from pursuing solely financial profits to simultaneously creating best values.

Join us if you would like to generate social and environmental impact alongside a healthy financial return.

Our methodology provides convincing opportunities for long term value creation, both financial and non-financial, while fostering a more sustainable future.

We have a robust and differentiated approach to support our impact investing research. Our research is centred around impact assessment, and a robust model has been built by a dedicated team of researchers with diverse thematic and expertise.

We work toward a green, inclusive, and resilient economy. We predominantly highlight transitional infrastructure in west Africa and emerging markets. Our main credentials encompass a range of overarching themes like:

- Impact private equity

- Transitional infrastructure

- Financial inclusion

- EdTech

- Sustainable food and agriculture

- New energy and climate

- A robust continually refined factor quant-focus investment pre-selection

A quantitative risk -based model sources opportunities from our on-the-ground diligence, idea library and proprietary screens, seeking out best opportunities. And a model-based portfolio is a function of risk/reward; seeking to minimize exogenous risks.

- Investment process supported by proprietary data science tool.

- Seek to quantify each investment thesis with a thorough model built out and verify key drivers through independent primary research.

- Trained on proprietary methodology.

- Continuously fine-tune our ability to read an interconnected world

- Portfolio diversification is not enough: understand the factor exposures to avoid important draw down.

- Follow on emerging themes and businesses.

- Automatically pre-assess hundreds of opportunities globally.

- Based on internal and external data sources

- Considers several pre-specified determinants.

- Updates investment pre-selection ratings automatically once new data is available or once there are charges.